Company Law does not differentiate hardware or software however state government can relax state taxes (VAT/Sales Tax) based on policies for a specific sector.

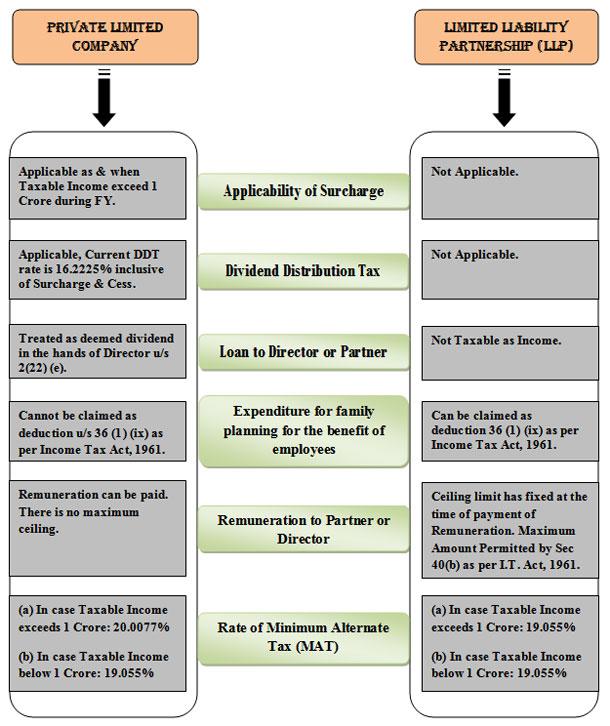

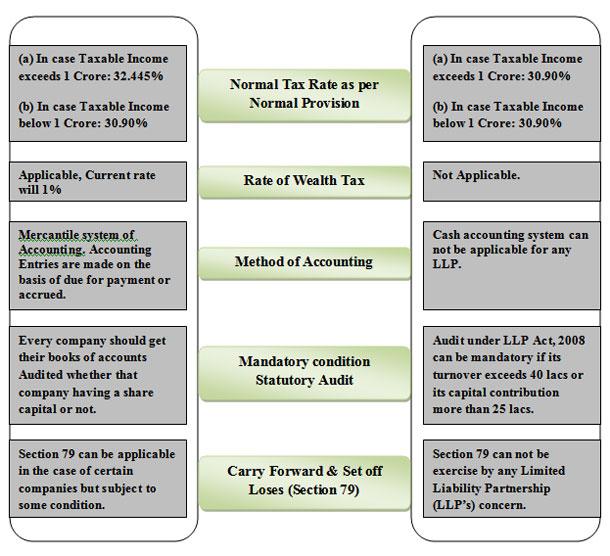

Following images compares the LLP and Pvt Limited Tax structure after the 2013 -

Please let me know if you have more specific query.